While politicians publicly debate Greece exiting the Euro behind the scenes comes a report of a secret order to print Drachmas as the currency pops up on Bloomberg’s ticker.

Author: Alexander Higgins

In public politicians refuse to entertain the notion that Greece may exit the Euro but behind the scenes another story is unfolding.

The World’s largest private printer of money De La Rue in the UK, who prints currency for 150 nation’s worldwide, is reported to have began secretly printing new Greek Drachmas according to a report from the well-respected German newspaper the Rheinische Post.

An intermediary paper company has told the Rheinische Post, speaking on the condition of anonymity, they are supplying the De La Rue with material to print the new Greek currency under a secret contract.

The Rheinische Post quotes the intermediary company as saying they have seen the new printed Greece currency with their own eyes.

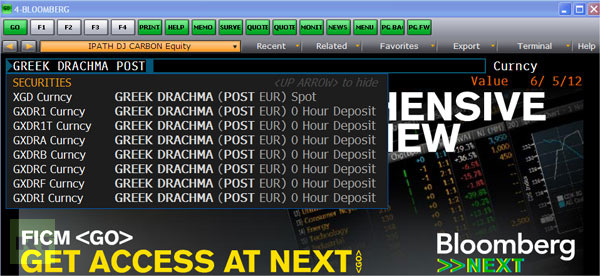

At the same time the currency showed up on Bloomberg’s trading terminal’s today listed as Greek Drachma Post Euro using the symbol XGD.

@russian_@economistmeg / Greek drachma post euro (XGD) shows up on Bloomberg

@russian_market / It’s really weird to see Drachma back on Bloomberg $XGD

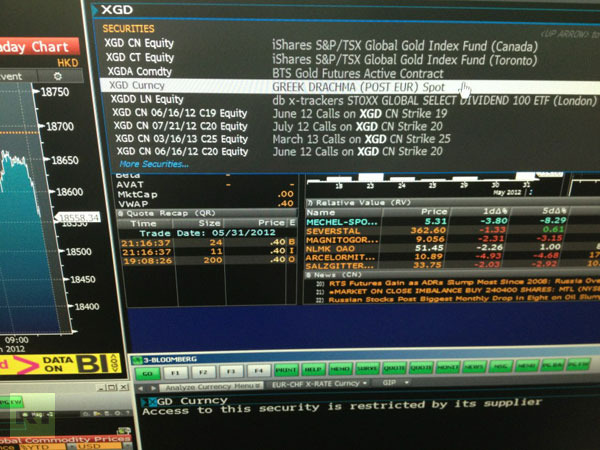

The Telegraph reported they tried trading the new currency but received a message saying “Access to this security is restricted by its supplier”

Bloomberg has responded saying the currency was being displayed as “an internal function which is set up to test”.

The currency has since been removed from their terminals.

RP- Online (auto translated)

Is the New Drachma Already Being Printed?

BY THOMAS Reisener – last updated: 01.06.2012 – 07:04

While politicians publicly [have not decided] yet on the fate of Greece in the Euro,a new version of the old Greek national currency apparently is being printed already at the world’s largest private money printer De La Rue, in a large printing company in the vicinity of Manchester, UK.

A paper company known to one of our editors based in North Rhine-WESTPHALIA provides material for printing of Drachmas at De La Rue through an intermediary. The middlemen, who must remain anonymous at the request of the company, say they have already seen the new printed drachmas with their own eyes.

De La Rue declined to confirm or deny the information on Thursday yet. “We generally do not comment on such speculation,” said a spokesman. De La Rue produces banknotes for over 150 currencies, and Greece was formerly part of the customer.

EU Trade Commissioner Karel De Gucht had recently said in an interview with the Belgian newspaper “De Standaard”, the European Central Bank (ECB) and the European Commission were already working on emergency situations in case that Greece withdraw from the euro-zone should.

“Eighteen months ago, like the danger of a domino effect existed,” said the Belgian EU Commissioner for the paper, referring to the danger of loss of credibility of other debt countries in Europe, “but now departments are working in the European Central Bank and the European Commission to emergency situations in case that does not succeed in Greece. ”

Source: RP-Online

From the Telegraph:

11.43 We’re not quite sure what to make of this, but it seems Bloomberg has created a currency code for the Greek drachma. We’ve just tried it out on our terminal and it leads to nothing but a blank screen and a message claiming: “Access to this security is restricted by its supplier”. It’s always best to be prepared, don’t you think?

RT reports:

Are we there yet? ‘Greek Drachma’ on Bloomberg ticker

Traders around the world have been staring at their Bloomberg screens, hardly believing their eyes. The electronic information platform has been showing details for possible Greek Drachma trading.

RT – Traders around the world have been staring at their Bloomberg screens, hardly believing their eyes. The electronic information platform has been showing details for possible Greek Drachma trading.

The Bloomberg helpdesk described it as “an internal function which is set up to test.”

The news comes in the wake of the heated discussions over the future of the euro zone and the membership of Greece. While many experts insist that Greece should leave the Euro and default, some suggest it should remain the union and introduce a parallel currency to the Euro to repay the country’s debt.

[…]

The Greek Drachma details have now been taken down from the Bloomberg service.

This article is reprinted from June 1, 2012 and exposes just how long the bankers have been milking Greek citizens. Matter of fact, look up “The Marshall Plan” to see just how far back Greek citizens have been getting screwed by international bankers and their own government.

Or watch the video below and you’ll see how deep the rabbit hole goes.